Article 10

The New Deal: Government-Sponsored Segregation

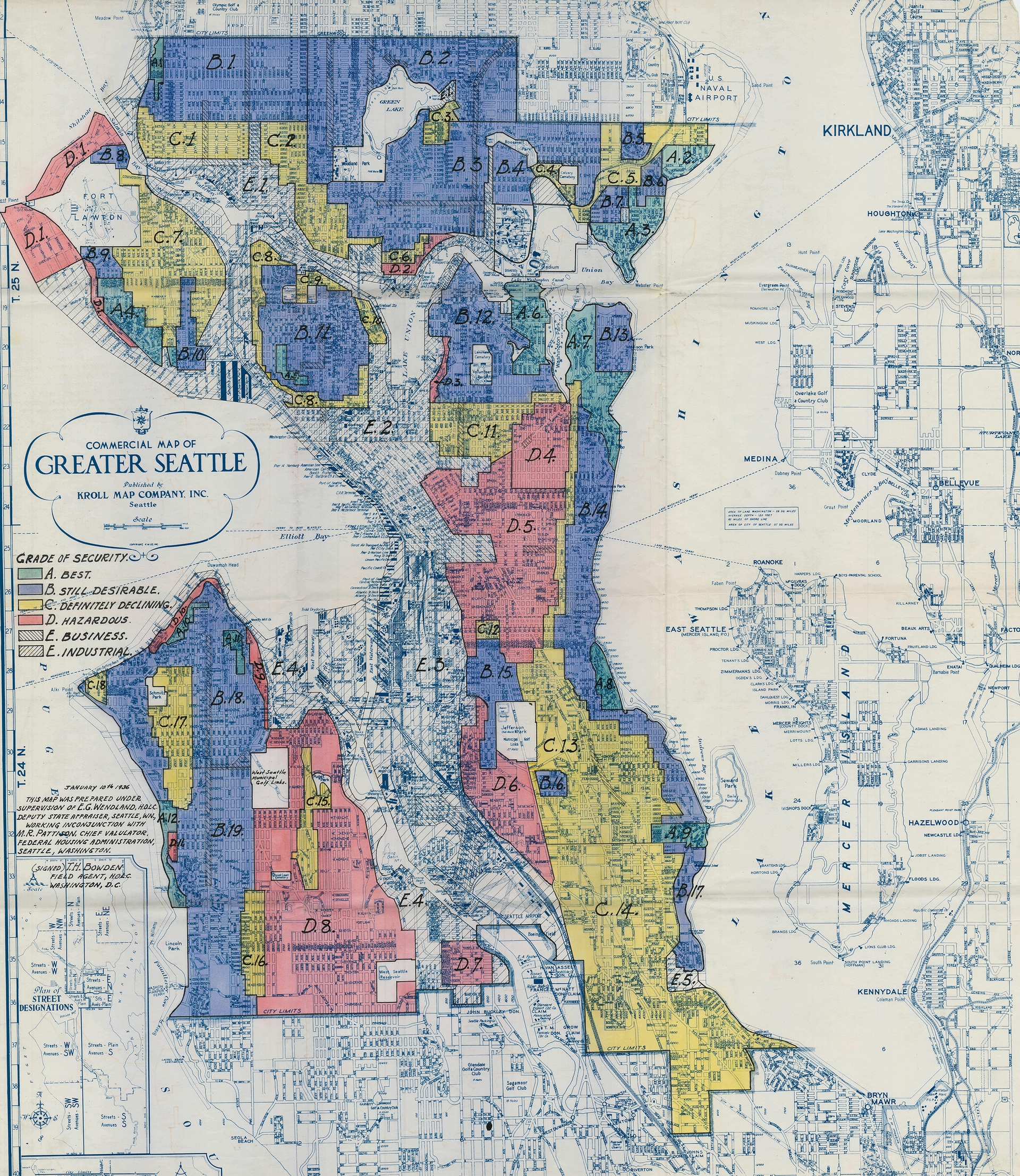

Courtesy of the National Archives and Mapping Inequality

How can you tell a good neighborhood from a bad one?

How much money should people be allowed to borrow for a home?

Can YOU get a loan?

The Federal Housing Authority advertises its home financing program to streetcar riders in Minnesota.

Courtesy of the Minnesota Streetcar Museum

Not many people can pay the full price for a house in cash. Most need to take out a bank loan to spread the large cost of a home over many years. Access to loans was almost impossible for lower-income Americans in the early 1900s. Only banks offered loans, and most required a steep 50% down payment and gave borrowers only 5 to 11 years to pay the loan back.

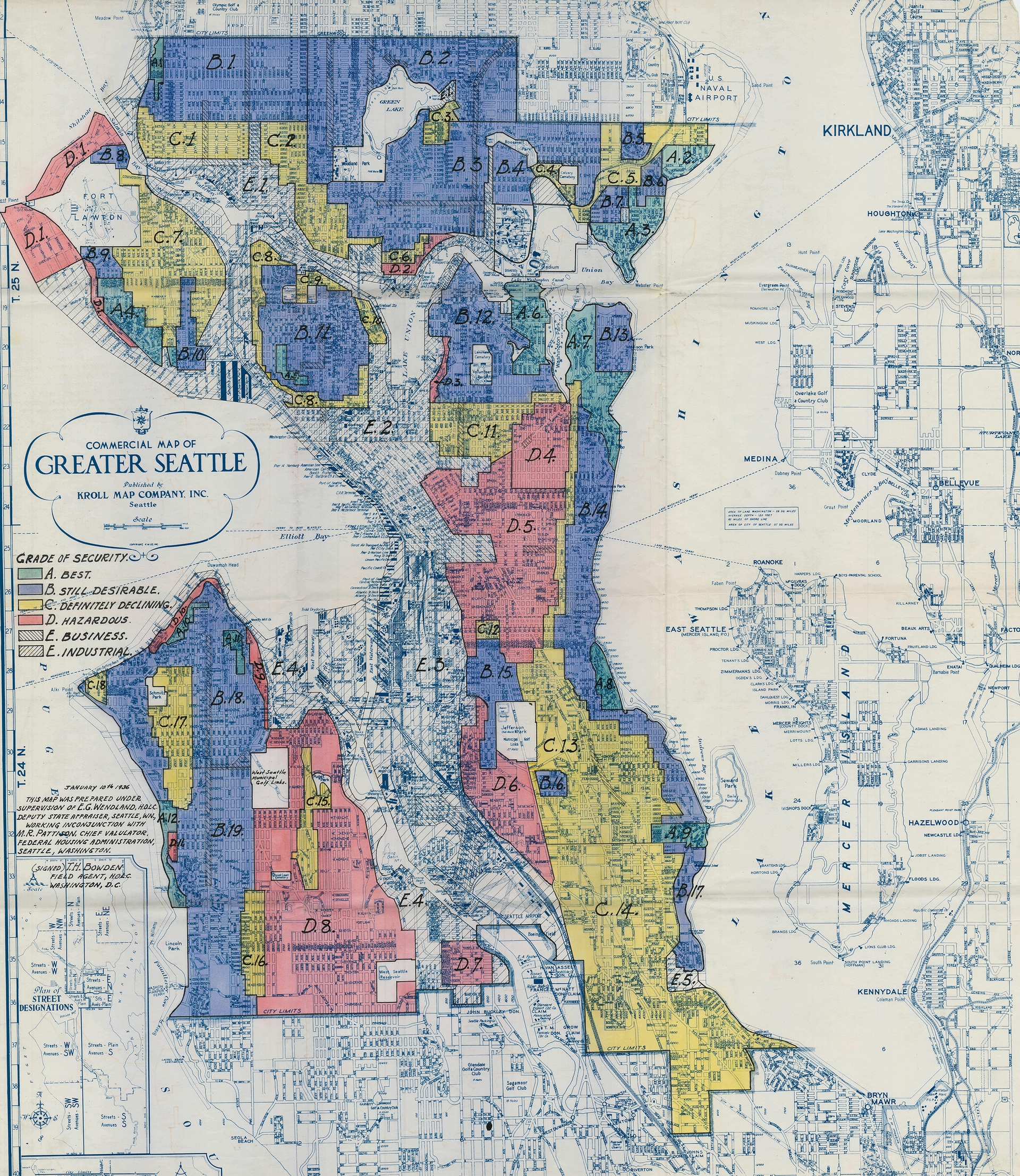

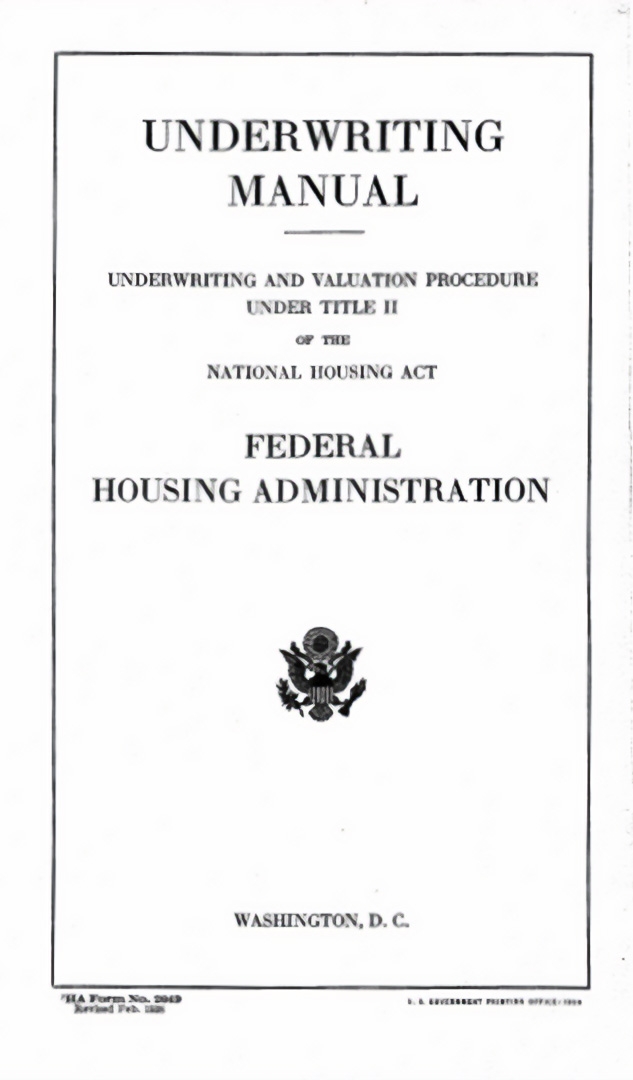

The FHA Underwriting Manual set guidelines for ranking neighborhoods and housing to ensure federal investments were secure. These guidelines included minimum building standards and endorsed racial and class segregation as markers of a stable neighborhood.

During the Great Depression, this system failed. By 1933, more than half of all mortgage holders, unable to pay, faced the loss of their homes. The United States government stepped in. New Deal homeownership programs helped to prevent mass homelessness and created much wider access to home loans.

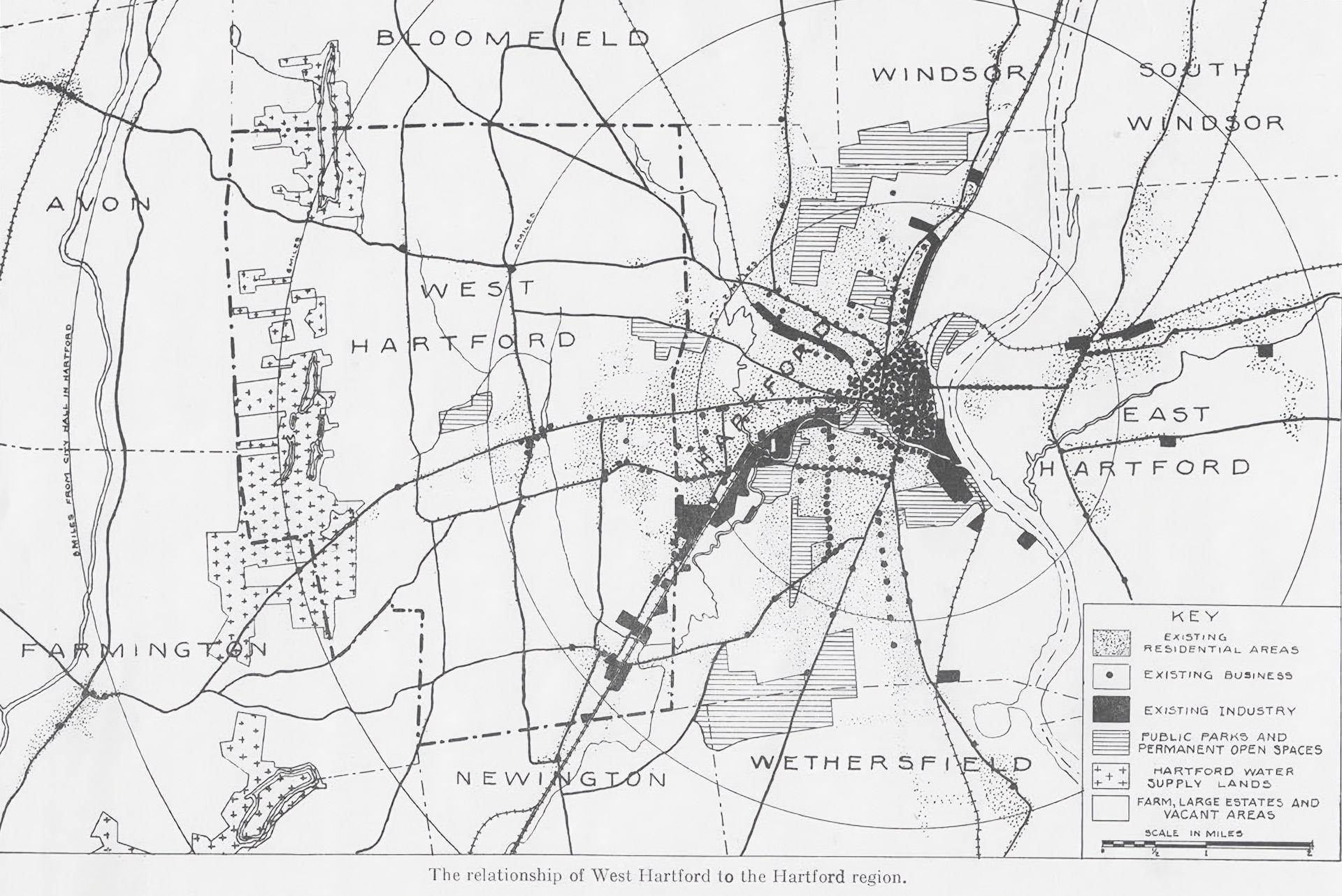

The Home Owners’ Loan CorporationHome Owners’ Loan Corporation (HOLC): A government-sponsored corporation founded with the Home Owners’ Loan Act (1933) as part of the New Deal. They issued bonds to fund the refinancing of mortgages from people struggling to afford their homes during the Great Depression. From 1935-1940, the HOLC commissioned a series of security maps for cities and towns that ranked and color-coded neighborhoods according to risk assessment. The racial and ethnic makeup of neighborhoods was a significant component, leading to redlining of Black neighborhoods.

(HOLC) was the first government-sponsored lending agency. It helped bail out nearly one million people who had almost lost their homes in the Depression. Soon after, the Federal Housing AdministrationFederal Housing Administration (FHA): Created by the National Housing Act of 1934, the FHA is an agency in the Department of Housing and Urban Development (HUD). The FHA provides mortgage insurance to FHA-approved lenders to mitigate lending risk and increase the capital available for property loans. Their 1934 Underwriting Manual helped establish racial and class segregation as an identifier of a good neighborhood investment. (FHA) expanded homeownership to many more millions of Americans. The FHA encouraged banks to loan to more people by guaranteeing that if buyers failed to pay, the loss would be covered. FHA loans paid up to 80% of the purchase price, opening home buying opportunities to people with much less cash in hand. Cheaper and safer than traditional bank loans, the FHA made home buying accessible to more Americans than ever.

Now that the government was involved in lending, it had to face the risk of losing public money if loans were unpaid. The HOLC and FHA made risk calculations based on racist ideas. The FHA discouraged banks from lending to buyers in or near racially mixed neighborhoods. A 1935 FHA Underwriters Manual warned, “If a neighborhood is to retain stability it is necessary that properties shall continue to be occupied by the same social and racial classes.” Banks sometimes demanded that borrowers enforce racial separation. In Detroit, developers built a six-foot tall, half-mile-long concrete wall to separate a new White development from an existing Black one. That “segregation wall” still stands today.

From 1935 to 1940, the HOLC created residential security maps for 239 metropolitan areas across the nation. This legacy lingers as nearly three-quarters of neighborhoods marked "hazardous" during the New Deal era are now low or moderate income neighborhoods.

Courtesy of the National Archives and Mapping Inequality

Beginning in 1935, the HOLC drew risk maps for 239 metropolitan areas. Safe or low-risk neighborhoods were rated “A” and shaded green. High-risk neighborhoods, rated “D”, were shown in red, giving rise to the term redlining.Redlining: Redlining is the practice of denying mortgage loans to people living in neighborhoods determined to be financially risky. The name comes from the Home Owners’ Loan Corporation (HOLC), which during the New Deal commissioned maps that color coded neighborhoods from Green (Best), Blue (Still Desirable), Yellow (Declining), and Red (Hazardous). It was virtually impossible to get a loan in a red area and almost every Black neighborhood was denoted as red. Residents in redlined neighborhoods were almost never approved for the reasonably priced, federally insured mortgages. All neighborhoods with Black residents were automatically redlined, regardless of the quality of the housing or reliability of the buyers. Local real estate leaders redlined neighborhoods based on their personal prejudices, often against Jewish, Italian, or Polish immigrants or poor Whites. With no access to federally guaranteed loans, residents in redlined areas were forced into exploitative loans or stuck in rentals. Redlining had a lasting impact on home values. Banks, developers, and landlords stopped investing in communities of color. Though redlining became illegal in 1968, neighborhoods continue to suffer from its effects.

A poster created by the Federal Arts Project for the New York City Housing Authority with the slogan that "Planned housing fights disease" with images of microorganisms.

Courtesy of the Library of Congress

Civil rights activists saw the racial bias in these federal programs. The Urban League, National Association for the Advancement of Colored People (NAACP), and the Black press investigated HOLC and FHA programs, confirming that segregation and discrimination were written into their design.

New Deal programs created a dual housing market—a White suburban one benefiting from frequent and large investments and a poor minority one experiencing mainly neglect. Segregation was so pronounced that in 1951, Senator and NAACP leader Clarence Mitchell said that the federal government had succeeded where the Ku Klux Klan had failed.