Article 15

Who deserves to own a home?

Courtesy of the Library of Congress

Who owns homes in America, and who does not? Why does it matter?

As a nation, have we ever agreed on the best ways to ensure shelter for everyone?

Should everyone be able to own their own home?

Housing in the United States sits at the intersection of need and want. Shelter is necessary for human survival. Yet, housing is a commodity to be bought and sold. Underlying all of this are fundamental questions about who society thinks should benefit from property ownership and who should not.

Ideas about what housing represents have changed over the course of US history. In early America, property ownership was limited to a very few, mostly White men. A woman or a person of color could own a home only in the most special of circumstances. Only property owners could vote, serve on juries, or run for office. To be a homeowner was to be a full citizen.

By the mid-nineteenth century, all White men had those privileges, but well-off Americans still aspired to own a home. It had become a symbol of family, security, and success. At the same time, many American homes did not match that ideal. In cities, tenement homes often doubled as factories for garment-industry piecework. Servants and farmworkers usually lived in the homes of their employers. Industrial workers in cities often lived in boarding houses, some of them owned by the companies they worked for. Most American families rented their homes. Ownership was just not possible for most people. The 1890 census was the first to ask if Americans owned their homes. Less than half did.

It was not until after World War II and the creation of government-supported loan programs that the majority of Americans became homeowners. After that, national homeownership rates increased each decade. Bankers, developers, government officials, and well-off Americans insisted that owning a single-family home was part of the American Dream. Americans also began to see homeownership as an investment, something that could be sold at a profit later on, and a way of saving to become more financially secure.

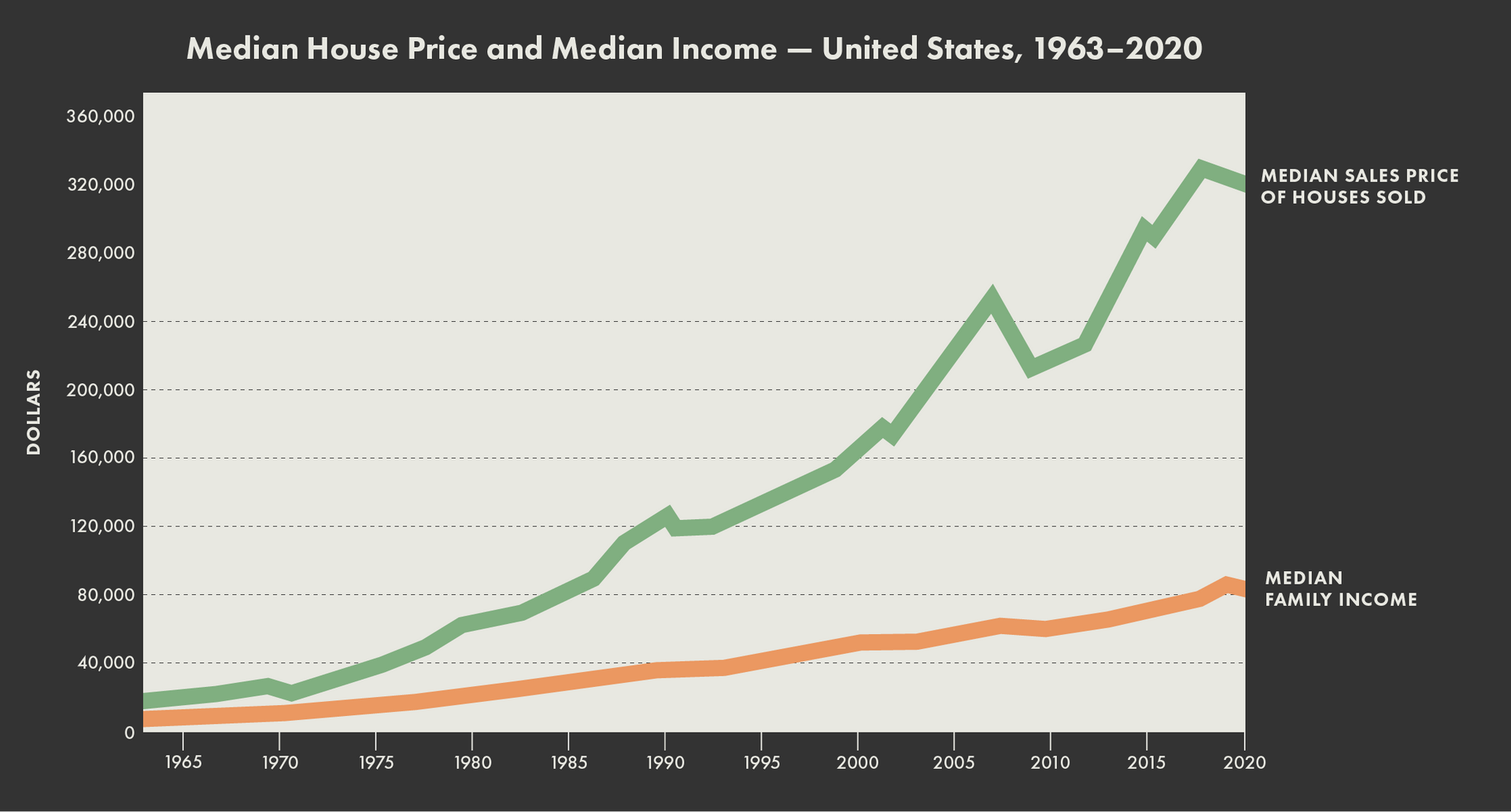

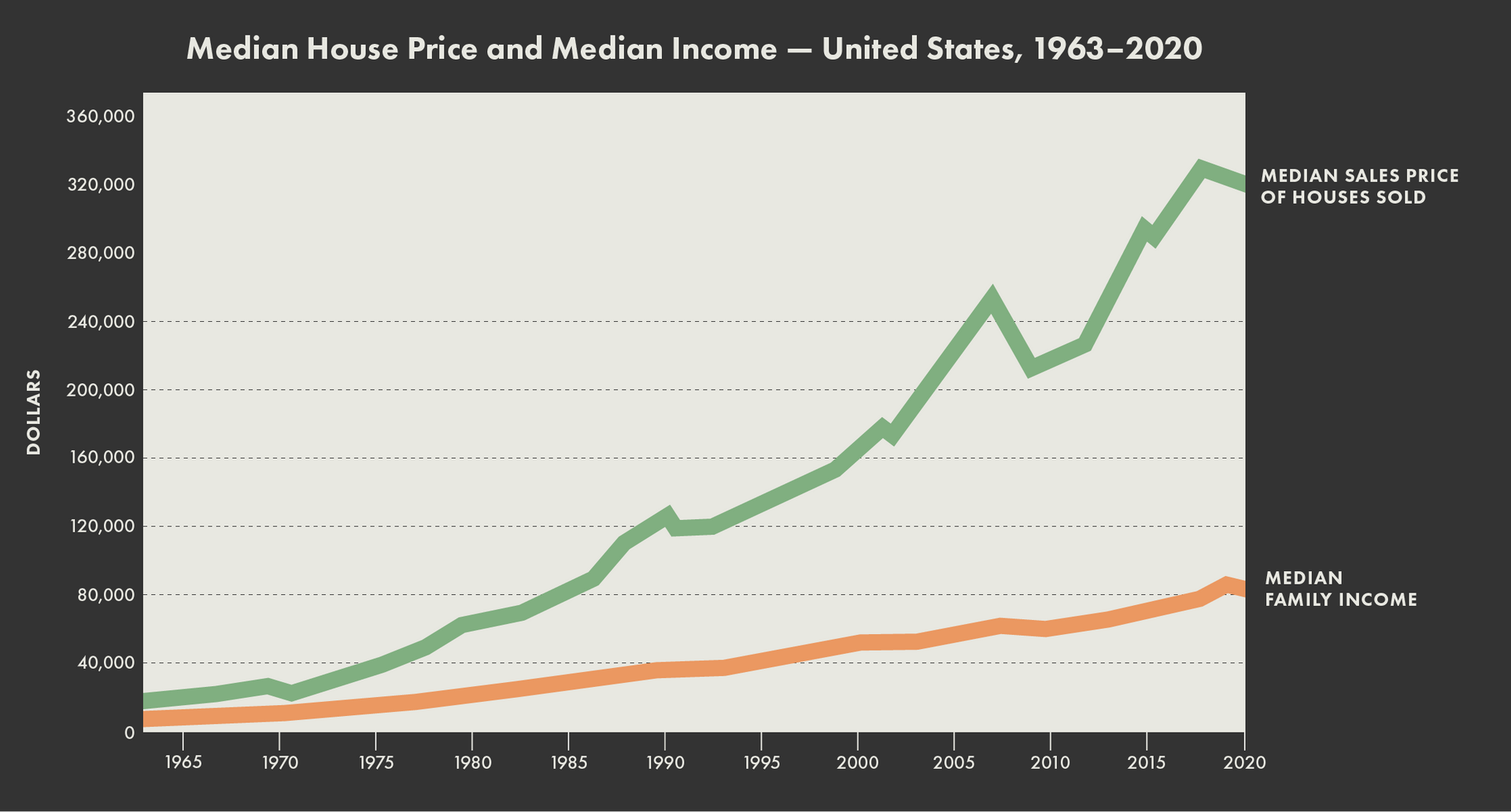

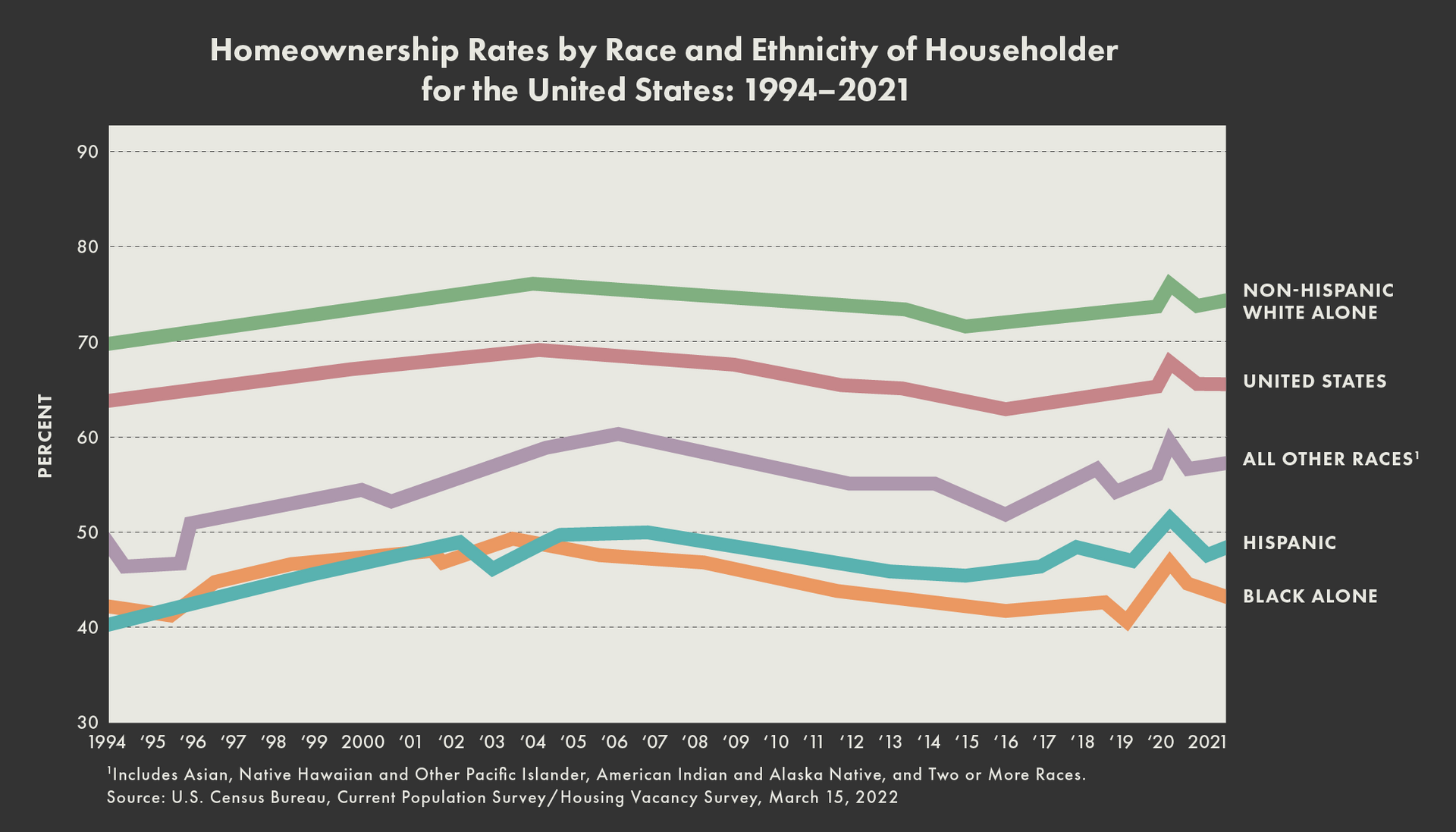

Homeownership still symbolizes middle-class success. But that success has been harder and harder to reach. Since 1970, housing prices have risen faster than wages, making it difficult for working people without other sources of wealth to afford a home. In 1950, the median home cost about 2.5 times the median yearly wage. By 2010, median home prices had risen to 4.5 times the median wage. Homeownership peaked in 2006, with 70% of Americans living in a home they owned. In 2020, the rate had declined to 66%.

Increases in house prices have outpaced the growth of family income since the 1960s.

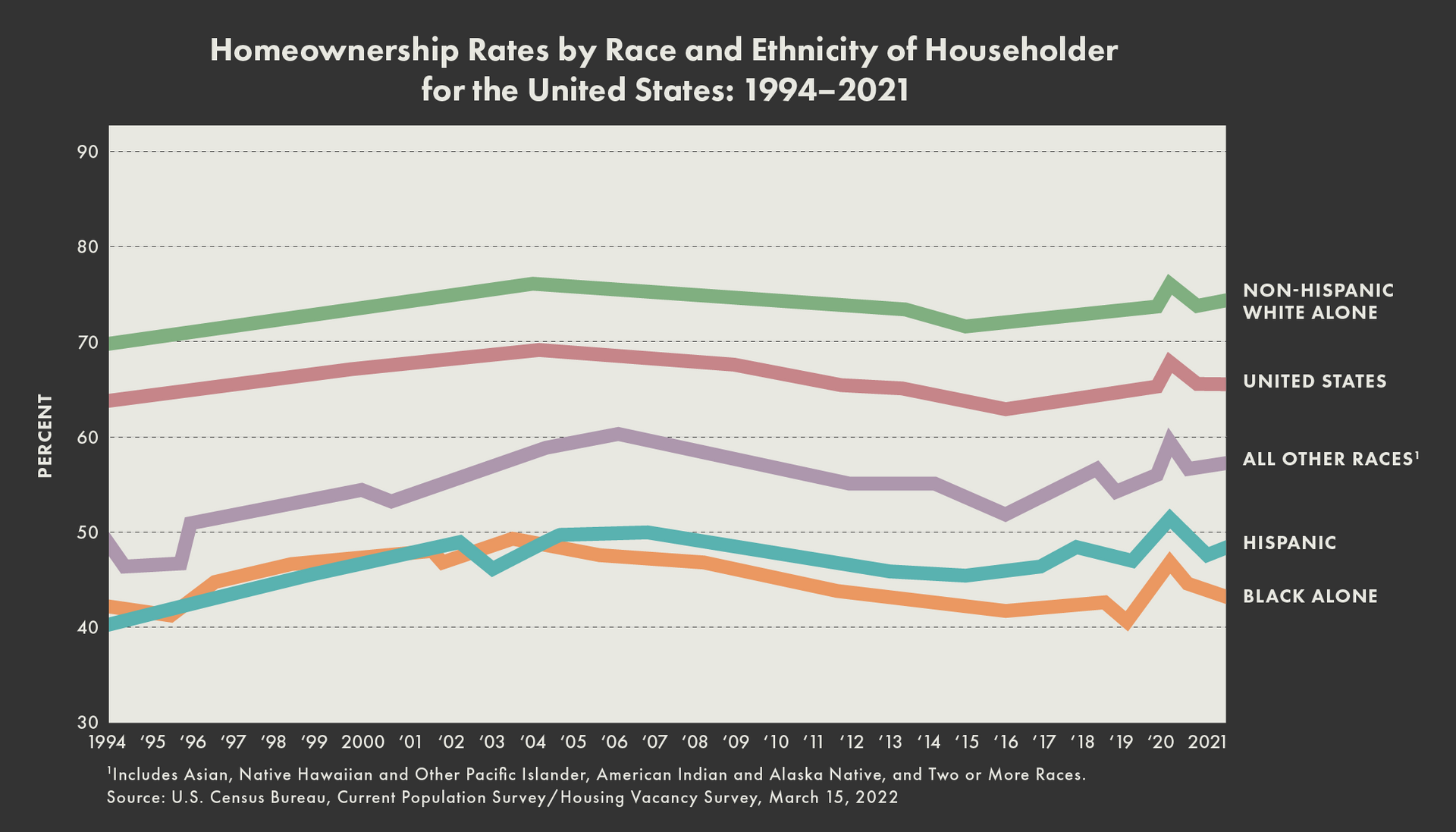

Homeownership is out of reach for many, especially people of color. And with it goes the chance to use a home investment to build intergenerational wealth. White Americans have long had an advantage. They were able to purchase homes earlier due to a larger share of accumulated family wealth. They had greater access to banking. Discriminatory practices reduced their competition. Homes purchased by past generations (or the cash from their sale) could be passed down to children and grandchildren, turning small gains into big differences over time and helping to create a racial wealth gap that has widened since the 1980s.

Homeownership matters. Where a person lives can make a big difference in their access to quality schools, good jobs, healthy foods, and safe streets. Owning a home is a way of saving money and building wealth. In 2019, the median White family held almost eight times the wealth of the median Black family. The gap between White and Black homeownership is greater today than it was when the Fair Housing Act was passed in 1968. White homeownership rose from 66% in 1968 to 70% today. Meanwhile Black home ownership remains stuck at 42%, exactly where it stood in 1968. For White working and middle-class Americans, homeownership was a key that unlocked the possibility of growing family wealth over the generations. The average homeowner’s net worth was $195,400, much of that in the form of their home; renter’s net worth averaged $5,400. This data shows that homeownership has been intentionally and systemically denied to people of color.